The fact that residential home prices are increasing substantially in

most regions of the country is music to the ears of homeowners. However, if you

are in the process of selling your home, make sure you realize the major

challenge a hot real estate market creates.

Each house must be sold twice; once

to a buyer and a second time to an appraiser who represents the bank that will

grant the purchaser a mortgage to buy the home (unless it is an “all cash”

purchase). In a real market with escalating prices, the second sale may be the

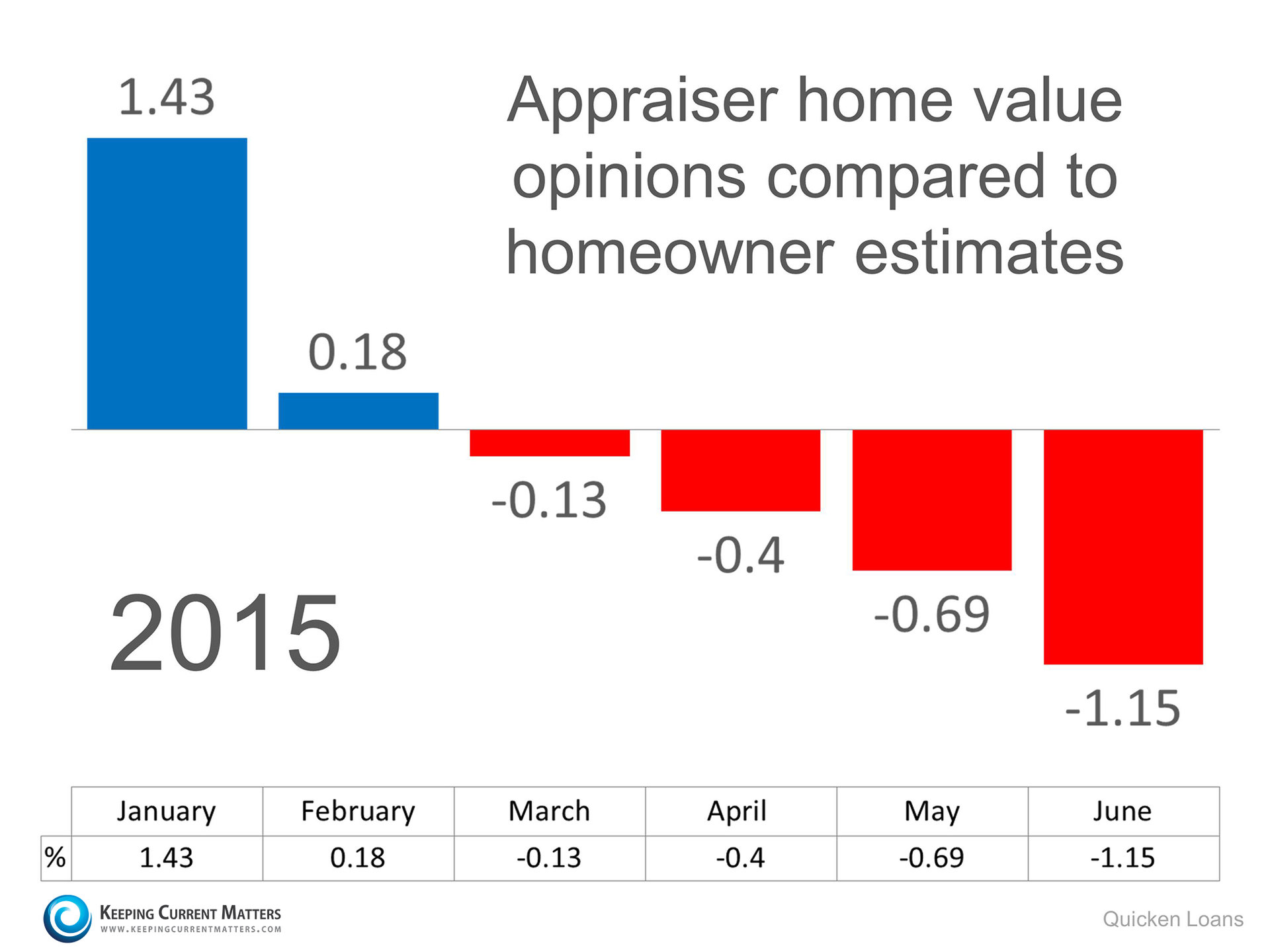

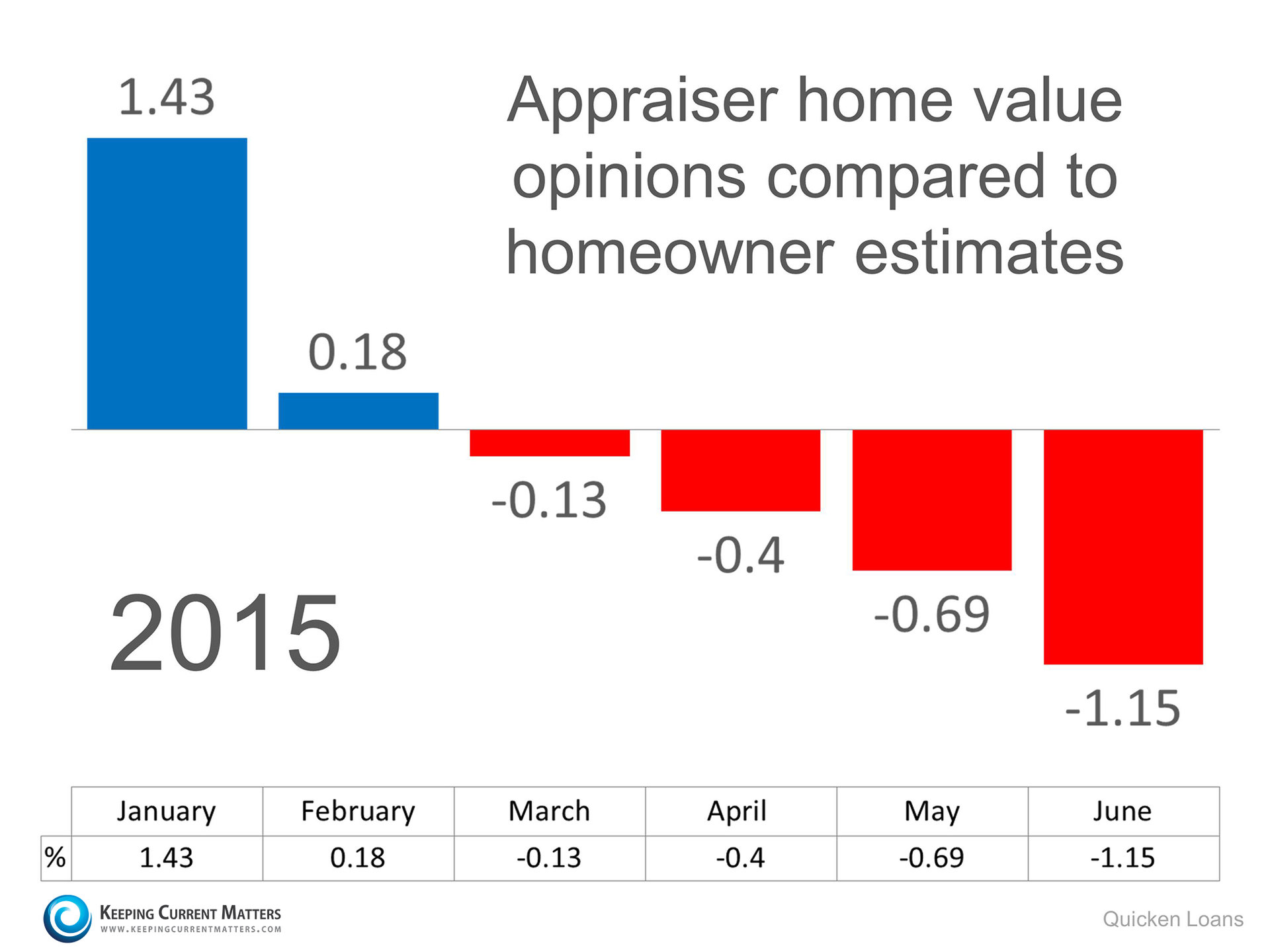

more difficult. And a recent survey by Quicken Loans reveals that the gap between what

a homeowner believes is the value of their home compared to an appraiser is

widening.

This

could lead to an increase in the percentage of real estate transactions being challenged

by a ‘short’ appraisal (where the appraiser value is less than the contracted

price of the home).

Bottom Line

Whether you are a buyer or a seller, you

must be prepared for this possibility as it may result in a renegotiation of

the price of the home.